About Us

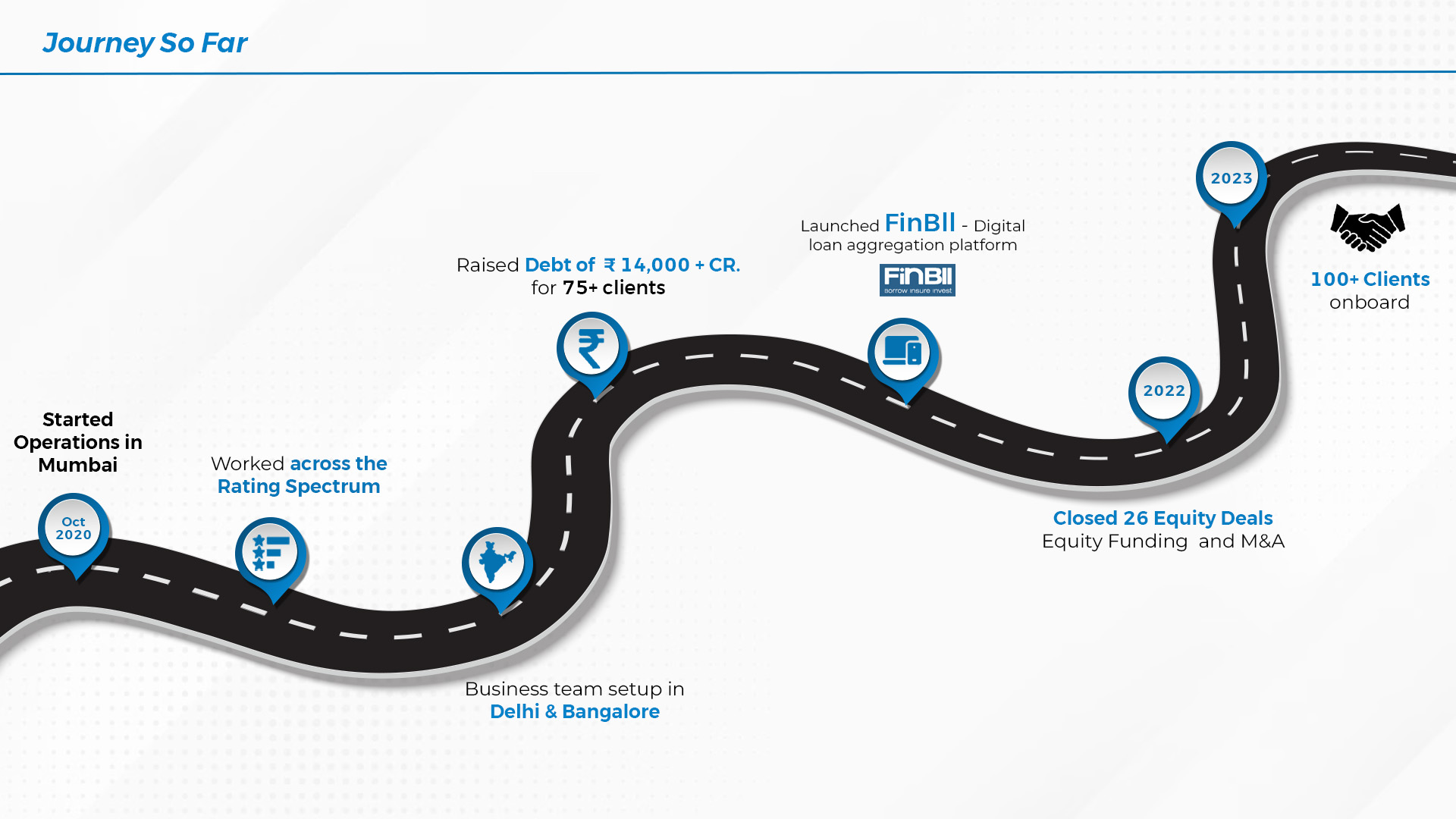

Capwise is one of the leading diversified financial advisors in India. We offer top-of-the-line Investment Banking services through Mergers & Acquisitions, and Private Equity fund raise, Debt Syndication and facilitate lending through our NBFC and Digital Integrated Financial Products Marketplace (FinBII). Incorporated in October 2020 by Mr. Naresh Biyani, we are based out of Mumbai with additional offices in Delhi and Bengaluru.

We have experience in closing some of the most complex M&A transactions in India. We have provided advisory services to both listed and unlisted companies to raise capital from funds, for both investment and exit opportunities. This has enabled us to rank highly on the league tables ever since our inception.

Our Debt syndication team focuses on providing capital to high quality businesses and entrepreneurs. We have a team experienced in providing innovative credit solutions through structuring, executing and raising debt from Banks and various other financial institutions. Also, our CEO, Naresh Biyani has experience and pedigree in debt syndication for over a decade bringing hsis own expertise and strong network.

FinBII, an integrated financial digital marketplace powered by Capwise Financial Products, is dedicated to providing an extensive array of lending products tailored to both B2B and B2C markets. It stands as a comprehensive destination for all lending requirements within the Indian lending marketplace, used by Banks/NBFC, Channel Partners and Borrowers.

We have a NBFC arm, Capwise Finance Private Limited, catering to fund requirements of MSME’s through various types of loan for short and long duration.

As a specialist Indian Boutique Investment Bank, we have positioned ourselves in various sectors of Industry as a preferred choice by Focusing on:

Expertise

- We have deep domain knowledge in every sector that we operate

- We have in-depth understanding of the local market

- Thorough knowledge of industry verticals through dedicated team with sector experts.

Strong Relationship

- Extensive Corporate and PE/VC tie ups.

- Collaborative relationship with other boutique and large investment banks across India.

Dedicated Team

- Professionals with prior experience in advisory/corporate finance.

- Well qualified and dedicated teams capable of executing on tight deadlines

- Culture of entrepreneurship and innovation, mixed with client first mindset.

Comprehensive suite of financial solutions to meet your diverse needs

Merger & Acquisitions

- Strategic Alignment & Target/Buyer Identification

- Business Valuation & Due Diligence

- Deal Structuring

- Marketing of Business

- Negotiation and Deal Closure

PE/VC Advisory

- Assessing and proposing the funds required

- Evaluating Funding Strategy

- Preparation of marketing collaterals

- Business Valuation

- Marketing of Business AIF

- Negotiation and Deal Closure

Debt Syndication

- Analysis & Customized Financing Solutions

- Lender Identification

- Negotiation and Documentation

- Ongoing Relationship Management

Bespoke Financing

- Restructuring & Turnaround Strategies

- Financial Analysis & Forecasting

- Stakeholder Management

- Pricing & Refinance Strategies

AIF Fund Raise

- Fund Structuring

- Regulatory Compliance

- Fundraising & Investor Relations

- Due Diligence

NBFC

- Business loans to MSME

- Revenue based Lending

- Supply chain Finance

- Bridge Finance

FinBll

- Facilitate Lending to both B2b and B2C markets

- Fully digital customer onboarding process

- Comprehensive KYC protocol

- End-to-End application processing

Awards and Accolades